The OXUS Network’s microfinance institutions (MFIs) in different countries seek to adapt their methodology to the specific context in which they operate. Nonetheless, their lending policy is consistent with a set of commercial and ethical principles. Recently, OXUS MFIs have been developing their activities in urban areas where small businesses grow more rapidly. However, the OXUS Network remains strongly committed to its development mission, and therefore plans to maintain a strong presence in less accessible locations.

A VARIETY OF LOAN PRODUCTS

OXUS MFIs strive to adapt their financial products to fit the specific needs and requirements of their clients. As a result, OXUS products vary from one country to the other; their specific conditions are regularly modified and updated. Generally, all OXUS MFIs offer at least two categories of products:

- Small credit network loan

The Small Credit Network loan (SCGL) was the first of ACTED’s microfinance products, and it remains very well adapted to rural areas, where the access to credit or deposit facilities is limited. Potential clients form networks of four to six individuals and jointly submit a loan application. Each member of the network is responsible for his or her own loan repayment, but members agree to guarantee each other’s loans. Nowadays, SCGL still account for over a third of OXUS MFI disbursements.

- Individual business loan

Individual Business loan (IBL) has been designed to be flexible and match the exact needs of OXUS customers. Potential clients for these loans already have a good knowledge of financial products and solid experience with their enterprise. IBL requires the provision either of goods or equipment that can serve as collateral, or of one to two other individuals willing to serve as guarantors. The amounts of individual business loans at OXUS generally vary between $100 and $50,000, with the average loan amount being about $680.

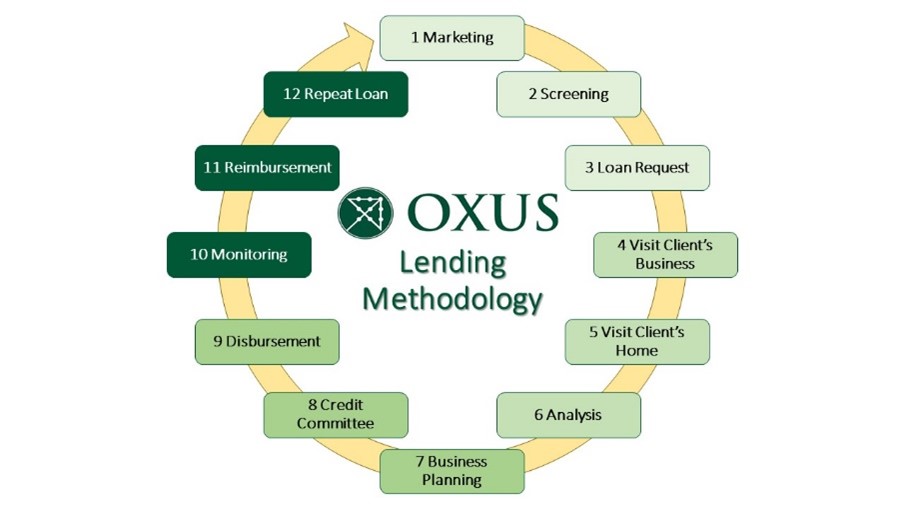

THE OXUS LOAN CYCLE

Any individual or company with an income generating activity, while meeting OXUS’ eligibility criteria and mission, can access a loan. Credit decisions are made based on objective criteria and are assigned to a client independently from the respective loan officer. A client’s first loan is usually probationary to understand their business activity and needs.

https://medikal.blognokta.com/golden-lovita.php